[Editor’s Note: This program dossier is excerpted from the full program profile, which is available to Aviation Week Intelligence Network subscribers at awin.aviationweek.com.]

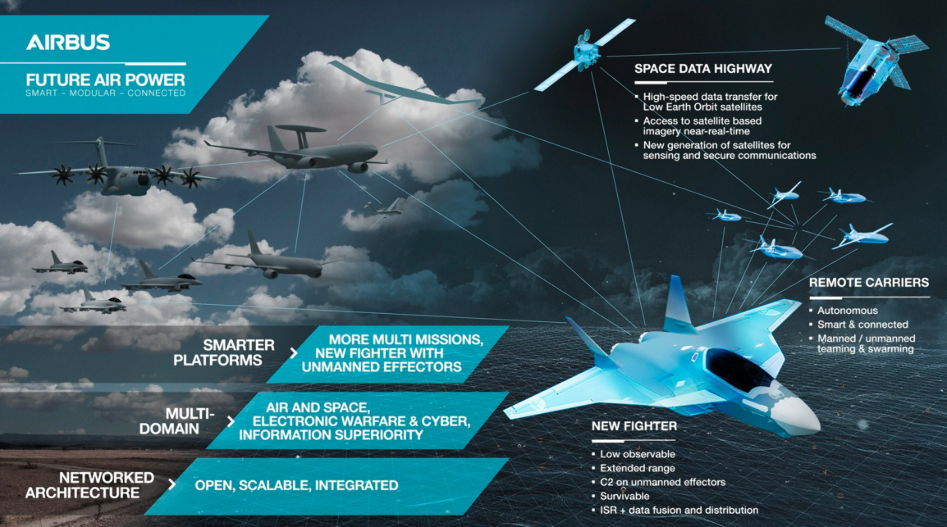

The Future Combat Air System (FCAS), or Système de combat aérien du futur (SCAF) in French, is a prospective system of systems (SoS) planned to enter service in 2040 to meet the air dominance needs of France, Germany and Spain. The core of FCAS will be the Next Generation Weapon System (NGWS), consisting of the new/next generation fighter (NGF), remote carrier manned-unmanned-teaming (MUMT) assets and air combat cloud (ACC). The NGF is expected to be a large, twin-engine, low-observable (LO) fighter. The ACC will enable the NGWS to network with the broader FCAS SoS including legacy airframes such as the Rafale, MRTT tanker and Eurofighter as well as a prospective space layer. The NGWS is being developed by each country’s respective industry partners, including Dassault, Airbus and Indra Sistemas.

Features & Variants

As of the time of this writing, NGF requirements are still at an early stage. However, the NGF is expected to be a large, LO design with significant range, internal weapons capacity and networked multi-spectral sensors. France largely appears to be driving the aero-vehicle requirements process, with Dassault and Safran designated as the lead authorities on their respective FCAS “design pillars.” French documents state the NGF will be able to enter highly contested airspace and secure air dominance as well as deliver nuclear weapons if needed. In October 2019, Admiral Prazuck told a French Senate hearing he expects the NGF to be a 30 metric ton (66,168 lbs.) class aircraft and a preliminary model at Le Bourget suggests an airframe 18 meters long (59 ft.). The Rafale has an MTOW of 54,000 lbs. and length of 50 ft vs. the F-22 with a length of 62 ft. and MTOW of 83,500 lbs. Generally, French designers have shown a preference for lighter designs, as evidenced from the divergent requirements from the Rafale vs. the Eurofighter, but size and weight growth are common at an early stage of development.

Airframe

Airbus and Dassault each have unveiled their own distinct aerodynamic configurations as well as one joint concept (pictured from left to right). As the NGF is in such an early phase in its development, only broad design preferences can be gleaned from such concepts. Dassault expects preliminary wind tunnel testing to begin in September of 2021. By May 2021, DGA’s Eva Portier (who serves as General Engineer, operational manager for FCAS) confirmed three different NGF configurations were under study. French requirements are likely to prioritize low observability, range and carrier suitability. Airbus Spain has been designated as the lead for the “stealth pillar” of the design work in partnership with Airbus Germany and Dassault. While these companies have LO design expertise with the LOUT and Neuron programs, it’s also worth noting that none of the companies involved have either significant LO manufacturing or LO maintainability ex¬perience. A great deal of the innovations made in LO technology with the advent of the F-35 and B-21 have been related to the manufacturing process – such as Lockheed’s laser-radar alignment system and other metrology-assisted assembly tools, which result in a lower lifecycle cost.

Airbus’ concept has remained consistent since it announced FCAS in 2016. The design features a prominent chinned nose trailing into a set of leading-edge root extensions (LEX) followed by a large pair of diamond wings and canted vertical tails. The concept features a pair of caret inlets leading into serpentine ducted intakes. Diamond wings are a popular design choice for tactical LO aircraft as they provide the lightest possible weight for the highest structural efficiency and control power needed for maneuvering. The addition of LEXs also could indicate a need for high angle of attack and pitch performance. Overall, Airbus’ concept balances LO while emphasizing the need for air combat maneuvering. Notably, Airbus’ first 2016 image also had provisions for two seats with the second aircrew assigned to task unmanned teaming assets.

Dassault’s concept revealed in 2018 represents the most aggressive approach to low observability among the three concepts. The design is tailless, featuring a flat ventral fuselage, caret inlets feeding into serpentine ducts and a blended body with a pair of large diamond wings. Such a design would sacrifice pitch, roll, and yaw authority for enhanced LO. In a 2019 presentation, Direction générale de l’armement (DGA) FCAS lead Philippe Koffi – who was previously DGA’s lead for the Anglo-French UCAV – explained that extensive LO requirements drove DGA to explore tailless concepts. The signature performance of tailless aircraft such as Neuron was very promising but the lack of control authority at supersonic speeds remains a significant challenge for the NGF.

He explained DGA was examining both thrust vectoring and fluidic control mechanisms to reduce the size of conventional control surfaces. Fluidic control relies upon the Coanda Effect to manipulate lift. By reducing or eliminating traditional flight control surfaces such as flaps, the aircraft would have less gaps or seams for creeping radar waves to interact with. However, it remains to be seen whether fluidic control technologies are mature enough to produce the low-airspeed handling characteristics France would need for carrier approach suitability. Thrust vectoring can provide excellent pitch control at supersonic speeds and, when integrated within a flight control system, can reduce the size of conventional control surfaces, thereby saving hundreds of pounds of airframe weight.

The joint concept shown in 2019 represents a hybrid of the design ethos of Airbus and Dassault. Notably, the platform features large lambda wings, optimized for subsonic cruise performance and extended range. The joint concept also is the first to feature diverterless supersonic inlets (DSI), which provide sufficient airflow without the external boundary layer diverter that accompanies caret inlets. Thus, DSIs offer improved signature performance as well as reduced weight and manufacturing complexity relative to caret inlets. The incorporation of V-tails, which combine pitch, yaw, and roll functions, provides superior LO performance relative to conventional four-tail arrangements – but not to the degree of tailless concepts.

Avionics/Sensors

Spain’s Indra Sistemas will lead the avionics pillar of FCAS in partnership with France’s Thales and Germany’s Future Combat Mission System (FCMS) consortium – consisting of Hensoldt, ESG, Diehl Defence and Rohde & Schwarz. Each nation has articulated few specific avionics requirements other than the NGF’s sensor suite will be multi-spectral, extensively employing networked passive detection and will be fused such that the broader family of systems obtains decision-making superiority. A DGA concept image unveiled in 2019 shows FCAS with what appears to be embedded side array mounted AESAs.

Both Indra and Hensoldt bring significant experience with respect to advanced, swashplate repositioner gallium arsenide (GaN) based AESAs such as the CAPTOR-E Mk. 1. The Mk.1 radar on order from Germany and Spain will use existing Mk. 0 components (baseline developed for Kuwaiti & Qatari Eurofighters) but will use new transmit/receive modules (TRMs) as well as a new digital multi-channel receiver. The array will feature at least 1,500 TRMs.

France’s Thales was the first European manufacturer to operationalize AESAs in fighter aircraft with the Rafale’s RBE2 in 2012. The RBE2 consists of approximately 1,000 TRMs. With Leonardo involved in the rival Tempest program, Thales arguably has the most robust TACAIR electronic warfare experience among FCAS primes. Thales Spectra ESM will be extensively overhauled as part of the €2 billion ($2.3 billion) Rafale F4 upgrade. The type already employs a number of advanced EW techniques such as active cancelation, phase interferometer-based geolocation, etc. Thales also is working to improve the multi-ship data link capability of the Rafale as part of the upgrade with the aim of maturing connectivity technologies for FCAS.

Weapons

As the NGF’s primary mission will be air dominance, the type likely will carry between six and eight missiles internally, but no official figures have been confirmed as of this time. In the offensive counter air (OCA) missile profile, a Rafale typically carries four BVR missiles (either Meteor or MICA-EM), two MICA-IR missiles, an internal GIAT 30 millimeter cannon with 125 rounds of ammunition and three RPL 701 1,250-liter fuel tanks for a total fuel capacity of 16,975 lbs. In a similar role, the Eurofighter typically carries an assortment of four to six BVR missiles, two to four IR-guided missiles, an internal 27mm Mauser cannon with 150 rounds of ammunition and up to three 1,000-liter fuel tanks. Given both the French historical design preference for lighter aircraft and the associated design tradeoffs in airframe size and weight with larger internal weapon bays, six missiles comprising four BVR and two IR weapons is a plausible minimum figure.

In French service, the NGF is expected to be compatible with the ASN4G hypersonic air-to-surface nuclear missile currently in development. Various air-to-surface munitions are expected to be added at a later date such as the MBDA Future Cruise/Anti-Ship Weapon (FC/ASW) which is expected to replace both the Storm Shadow/SCALP in UK and French service. For stand-in munitions, MBDA has developed its SmartGlider and SmartCruiser munitions. The SmartGlider light weighs 120 kg, is over 2 m long, has a warhead of 80 kg and range of more than 100 km. The SmartCruiser is powered and extends the weapon to 200 km. The heavy version weighs 1,300 kg and features a 1,000-kg class warhead. MBDA has said six of the light munitions would be able to fit on a “smart rack” externally on fourth-generation fighters or two racks of four internally on the NGF. The weapons would be linked with the NGWS’ combat cloud for cooperative and autonomous engagement of targets with laser, GPS, and infrared guidance. MBDA further developed its concept into its RC100 and RC200 remote carriers.

Remote Carrier

Manned Unmanned Teaming (MUMT) has been a core focus area for Airbus even prior to the start of the Franco-German partnership. Airbus Germany was selected as the developmental lead for the Remote Carrier (RC) design pillar in partnership with MBDA Germany, MBDA France and Spain’s SATNUS (a consortium of Sener Aeroespacial, GMV and Technobit-Grupo Oesia). Remote carrier technology demonstrators will fly before the end of 2027 as part of Phase 1B and an initial operational capability is expected by the 2030s to complement fourth-generation fighters. It’s clear that the FCAS’ MUMT concept of operations (CONOPS) and associated requirements – which define both the RC’s airframe and control system capabilities – are still being studied.

French sources discuss RCs as a means to suppress or destroy enemy air defenses (SEAD/DEAD) like the S-400, conduct intelligence, surveillance and reconnaissance (ISR), electronic warfare, battle damage assessment, and even launch missiles against other aircraft. As of February 2019, French planners were exploring four capability sets with respect to size – a loyal wingman type weighing a few tons, a cruise missile, smart glider and smaller systems. By May 2021, DGA’s Eva Portier confirmed six different RC configurations were under study. Broadly, the FCAS partners appear to concur with the market trend away from very large, very low-observable UCAVs costing tens of millions of dollars each like the X-47 and nEUROn. Using USAF terminology, MBDA has focused its initial efforts on expendable ($100k to $2 million) remote carrier concepts while Airbus has focused on higher-end attritable ($2-20 million) designs.

In 2019, MBDA unveiled its RC100 and RC200 remote carrier concepts. The RC100 is derived from its SmartGlider concept and closely resembles a cruise missile with a prominent forward chine to reduce its RCS and foldable fins for stowage. Its airframe measures 1.8 meters (5 ft. 11 in.) long and weighs approximately 120 kg (265 lbs.). The larger RC200 is 2.8 meters (9 ft. 2 in.) long, weighs 240 kg (529 lbs.), and is capable of reaching speeds of Mach 0.7-.85 and 4 g of maneuvering performance. The RC100 and RC200 are not recoverable and are intended to saturate an adversary’s integrated air defense system (IADS) as decoys (like MALD), jammers or networked passive sensors. The larger RC200 could be armed with a warhead.

Airbus’ much larger RC is closer in size to the Storm Shadow cruise missile, which weighs 3,000 lbs. and is 16 ft. long. With the increased space power and cooling capacity comes additional possibilities for disaggregated passive sensing for air dominance or EW for SEAD/DEAD.

Airbus marketing materials show one NGF controlling four RCs, which are launched from its A400M transport. As of March 2021, Airbus has ground-tested a prototype mechanism to deploy an unmanned aircraft from the rear ramp of an Airbus A400M airlifter. The unmanned aircraft used is an Airbus Do-DT45 twinjet target drone and the deployment mechanism is a ramp mounted on the lower cargo door that launches the aircraft tail-first into the airflow behind the A400M. Airbus is working with German companies Geradts and SFL as well as the DLR aerospace research agency. Going from concept to prototype in six months, the project is demonstrating the capability to deploy unmanned aircraft from the rear ramps of transport aircraft to conduct reconnaissance or other missions in areas that they cannot reach independently.

In response to Parliamentary questioning by MPs Tobias Pflüger, Christine Buchholz and

Heike Hansel in April 2021, the BMVg outlined its RC technology maturation efforts for both airframe and control systems/distributed autonomy:

• Learjet-controlled and directed groups of DT-25 target drones in October 2018. A more complex, multi-domain demonstration is scheduled for 2022

• CASIMUS II study using H145 as a control platform for Luna NG drones

• Autonomous, Reconfigurable Swarms of Unmanned Vehicles for Defense Applications (ACHILLES) funded by the European Defense Agency (EdA) to mature positioning, navigation and timing, CNS: communication, navigation, identification [surveillance], ATM-UTM: air traffic management - UAV traffic management, UAV: Unmanned Aerial Vehicle - unmanned flying objects).

Arguably more important than the remote carrier’s airframe will be its control system and data link. Airbus’ data link technologies were tested during the August 2021 Timber Express exercises held at Jagel airbase, in Northern Germany. Airbus says remote carriers will use a Compact Airbus Networking Data Link and this system was successfully connected with the Link 16 tactical datalink. “The remote carriers were not only visible to all tactical combat aircraft of the Air Force but could also receive and execute orders without the need for technical modifications to the aircraft,” Airbus says. The networks were set up in line with security regulations and NATO classification levels, the OEM notes, adding that the demonstration was a “further milestone” towards the FCAS. As part of the same event, teams also demonstrated a concept of Co-operative Electronic Support Measures Operations (CESMO) a reconnaissance network aimed at locating threat systems in the electromagnetic spectrum in real time. Airbus says it was able to bring the remote carriers into the CESMO reconnaissance network during the exercise and their results were shared with an in-flight suppression of enemy air defense-tasked Tornado aircraft.

Engine

The NGF will be powered by a pair of Next European Fighter Engines (NEFE) produced by the European Military Engine Team (EUMET), a partnership between Safran and MTU. The former will be the lead designer and systems integrator while the later while be responsible for maintenance, repair and overhaul functions. EUMET will be led by a Safran nominated CEO and based in Munich. Spain’s ITP Aero is expected partner with EUMET as development progresses.

French sources state NEFE will produce at least 12 metric tons of thrust each (26,656 lbf. or 52,911 lbf. total). MTU had previously stated a requirement for 30,000 lbf. of thrust. Improving the operating temperature of the core will be critical toward achieving the EUMET’s higher thrust targets. Safran’s M88-2 produces 17,000 lbf., operates at 1,850° C, weighs 1,977.5 lbs. and has an inlet dimeter of 27.5 in. Even accounting for size with a 43-in. inlet diameter, the Pratt & Whitney’s (P&W) F135 is a higher-performance engine, producing more than 44,000 lbf. P&W achieved this in part due to its higher operating temperature around 2,000C°. Safran has announced plans to demonstrate NGF technologies on a modified M88 in 2027 which the company hopes will be able operate at 2,350°K or more than 2,000°C.

EUMET will seek to keep the diameter of its new engine small as the space within an LO aircraft’s outer mold line is very limited with the need for an internal weapons bay and fuel. Increasing engine diameter would add depth to the fuselage with significant weight and cost penalties.

The DGA also has directed Safran to explore variable cycle engine technology with the goal of maintaining high thrust at supersonic speeds and reducing fuel consumption when cruising at low altitude. A key feature of an adaptive-cycle engine is the ability to vary bypass ratio. The ratio can be made high for good fuel efficiency in cruise and loitering flight or low to improve combat performance. The third stream of air also can provide additional cooling capacity for avionics. Power and thermal management (PTMS) for avionics and systems cooling is arguably more important than thrust in modern combat aircraft.

Production & Delivery History

Overview

FCAS’ acquisition strategy is particularly complex, involving a patchwork of multinational industry, political and military-to-military agreements. The NGF could replace more than 450 Rafales and Eurofighters in the service of France, Spain and Germany after 2040. Preliminary estimates place the total program cost at more than €100 billion ($117 billion). The French government expects total development funding among the three nations to cost €8-9 billion ($9.4-10.6 billion) through 2030. France’s DGA is the lead contracting agency for the entire project on behalf of Spain, Germany and France. This section will provide an overview of the FCAS acquisition strategy, funding and country-specific concerns prior to a comparison against other major fighter programs. At the government level, FCAS’ development has been divided into three phases from 2019 to 2030 as shown below.

In February 2019, Germany and France awarded Dassault and Airbus €65 million Joint Concept Studies (JCS) that would build upon the HLCORD to provide capability and trade space analysis. The JCS ran through 2021, lasting approximately 24 months. The French government also sought to ensure the viability of its domestic turbofan industrial base with a €115 million investment as part of Turenne 2 started in 2019.

Launched in February 2020, Phase 1A marked the beginning of the definition and development phase. The effort encompasses the first substantial R&D work to defining the FCAS’ future architecture between 2020-2022 (18 months). Phase 1A also marked the definition of seven design pillars as well as national industry assignments shown on the Airbus graphic above. The preliminary work share was divided between Germany and France with an investment of €77.5 million each, but Spain was added on an ad hoc basis in July 2020. It’s worth noting Airbus Germany leads the RC and combat cloud pillars while Airbus Spain leads the LO design pillar. The simulation pillar is a joint effort with co-equal participation. As of January 2021, Airbus’ Vice President and head of FCAS Bruno Fichefeux stated €300 million had already been spent by the partner nations.

Phase 1B & Phase 2 (2021-2027)

Phase 1B will run from 2021 to 2024 and will define FCAS’ architecture with foundational R&D investments. In August 2021, the defense minister of Spain, France and Germany agreed to a total FCAS budget of €8.6 billion through 2027. A total of €3.6 billion ($4.2 billion) will be spent as part of Phase 1B, split among the partner nations equally. The remaining €5 billion will be spent on Phase 2 from 2024-2027 which will result in a series of flying demonstrators.

Earlier, France’s 2020 Finance Act authorized €1.4 billion for initial FCAS R&D work. On June 23, Spain’s Council of Ministers approved FCAS Phase 1B and Phase 2 funds worth €2.5 billion through 2027. The contributions will be made in annual payments starting with €113 million in Fiscal Year (FY) 2021 funds. In June, German Defense Minister Annegret Kramp-Karrenbauer (AKK) requested parliamentary approval for Phases 1B and 2. The Bundesrechnungshof (Federal Audit Office) reported AKK’s proposal would cost €4.468 billion ($5.3 billion) through 2027.

This sum represented €1.3 billion ($1.5 billion) in Phase 1B funding and approximately €1 billion ($1.17 billion) in supplemental funding towards German industry outside of the tripartite agreement – leaving approximately €2.168 billion ($2.5 billion) for Phase 2. Much to the dismay of France, the Bundestag only authorized €1.3 billion for Phase 1B on June 23, 2021. The SPD’s Dennis Rohde on the budget committee explained, “With the follow-up project to the Eurofighter, FCAS, we still have numerous questions…We have formulated clear conditions for the further progress of the project and thus take into account the criticisms of the Federal Audit Office and those of the Federal Armed Forces Procurement Office [BAAINBw].” Broadly, the Greens and SPD have been less supportive of FCAS than the CDU – particularly of armed remote carriers. However, the SPD-Greens-Free Democrats (FDP) coalition agreement announced in November acknowledges utility of armed UAVs in force protection missions.

Beyond 2030

The DGA has released few details of the program’s development schedule beyond Phase 2. MTU’s FCAS engine lead, Peter Harster, confirmed detailed milestones exist beyond 2027 through 2040, including Phase 3 development, but could not be released publicly. The NGF is expected to first fly in 2035, some seven years after the demonstrators. The NGWS is expected to enter operational service in 2040.

Topline spending estimates vary, but a 2020 French Senate report lists the development and production cost of FCAS (among all nations) at €50-80 billion ($58.7-93.7 billion). More recent reporting suggests at least €100 billion ($117 billion). This figure is in line with historical spending among the three nation’s fourth-generation fighters, which cumulatively totals approximately €80 billion. The DGA has yet to release detailed cost figures beyond 2030. However, Spanish sources estimate the country will spend at least €25 billion ($29.3 billion) through the development and production stages of FCAS. With the tripartite split in development costs and France and Germany ordering significantly more NGFs than Spain, FCAS’ total development and production figures easily could reach €100 billion. BLDI estimates FCAS will add 30,000 jobs in Germany and the “gross value added” to the German economy will average €1.2 billion per year, peak at €2.3 billion per year and total €84 billion by 2090.

To compare to U.S. programs, the Congressional Budget Office (CBO) estimates the USAF’s Penetrating Counter Air platform – the manned fighter element of Next Generation Air Dominance (NGAD) family of systems – would have a fly-away cost of $300 million. The total buy of 414 fighters could reach $130 billion. CBO’s figures do not include RDT&E funds. A reasonable comparison would be the latest 2010 Selected Acquisition Report, which estimated the F-22’s total program RDT&E figure at $32.4 billion ($39.15 billion in 2020 dollars). With an initial operational capability around the turn of the decade, the USAF’s NGAD is approximately ten years farther along than FCAS. In FY2015, DARPA launched the Aerospace Innovation Initiative (AII) with the explicit purpose “to develop and fly two X-plane prototypes that demonstrate advanced technologies for future aircraft” – one for the USAF and one for the Navy. A USAF NGAD demonstrator was flying as early as September 2019, confirmed by September 2020. NGAD RDT&E spending through FY2025 is expected to reach at least $10.5 billion, not including the $4 billion in investment in adaptive cycle engines since 2006. The Next Generation Adaptive Propulsion (NGAP) is scheduled to deliver a certified engine in FY25 with flight testing as early as FY26 – not merely as a flight demonstrator.

- Matt Jouppi, [email protected]