LYON, France—Safran has made a $1.8 billion offer to acquire Collins Aerospace’s actuation and flight control systems business from RTX (formerly known as Raytheon Technologies), thus positioning itself for the design of more-electric control systems on the next generation of commercial aircraft.

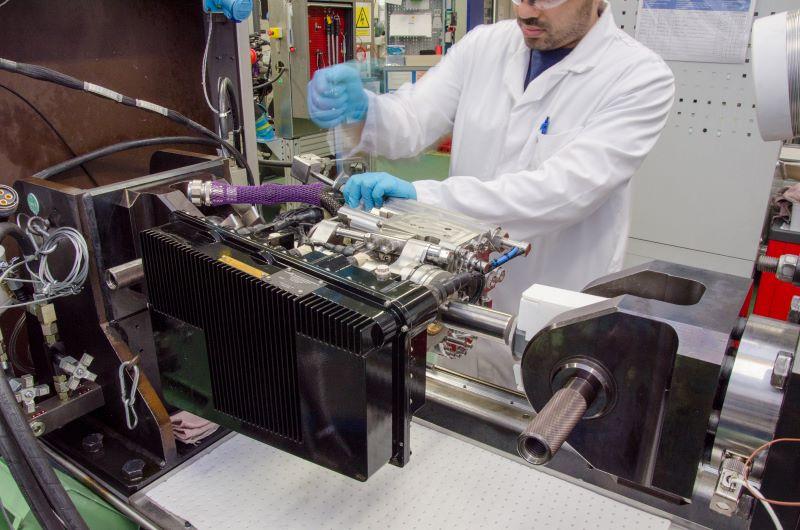

The products Safran intends to integrate in its portfolio can be likened to the muscles in a flight control system. They actuate primary controls, such as flaps, and secondary ones, such as slats. Combining Collins’ know-how in conventional mechanical and hydraulic actuation with Safran’s technology in electric actuation may ideally place the acquirer for future hybrid actuation systems.

“We believe the next short- to medium-range aircraft will rely on hybrid actuation, with mechanical, hydraulic and electric devices,” Safran CEO Olivier Andries said July 21 during a press briefing. Electro-mechanical and electro-hydraulic actuators are in service on some types of the current generation. However, adoption has been slower than expected in the early 2000s. Safran sees the electric actuation content growing to 50% in the next generation of aircraft, from the current 10%. In the longer term, Safran expects the proportion to grow to 90%.

Collins’ actuators can also be found on nacelle doors and thrust reversers, as well as landing gears. The activity is dual civil-military and includes fixed-wing aircraft, helicopters and missiles. For flight controls, an application is the Lockheed Martin F-35 fighter, Andries noted.

Safran is still a marginal player in the sector, he said. With the takeover, it may become a global leader, competing with Eaton, Liebherr-Aerospace, Moog and Parker Aerospace, he added.

As part of the deal, Collins will become a customer for 25% of Safran’s new activity, typically for nacelle actuators.

The business line is seen as fitting Safran’s DNA. “These are critical systems, with high barriers at entry, potential for growth and solid aftermarket revenues,” Andries said. Maintenance accounts for 40% of the revenues. This is largely due to the fact that 90% of the systems are “built to spec,” meaning the supplier owns the design.

The move will add 3,700 employees to Safran’s payroll. Of the eight engineering, production, and maintenance sites, seven are located in Europe.

The revenues of the business Safran is to acquire are predicted at $1.5 billion in 2024. Subject to regulatory approvals and consultation with employee representative bodies, the deal is expected to close in the second half of 2024.