Folding Wencor into its aftermarket parts and services portfolio will greatly expand Heico’s offerings while creating little overlap between the two suppliers, Heico executives said.

Heico’s acquisition of Wencor, announced May 15, combines two of the largest FAA-approved parts manufacturer approval (PMA) specialists. But their catalogs differ in a few key areas, Heico Flight Support Group (FSG) President Eric Mendelson said on a recent earnings call.

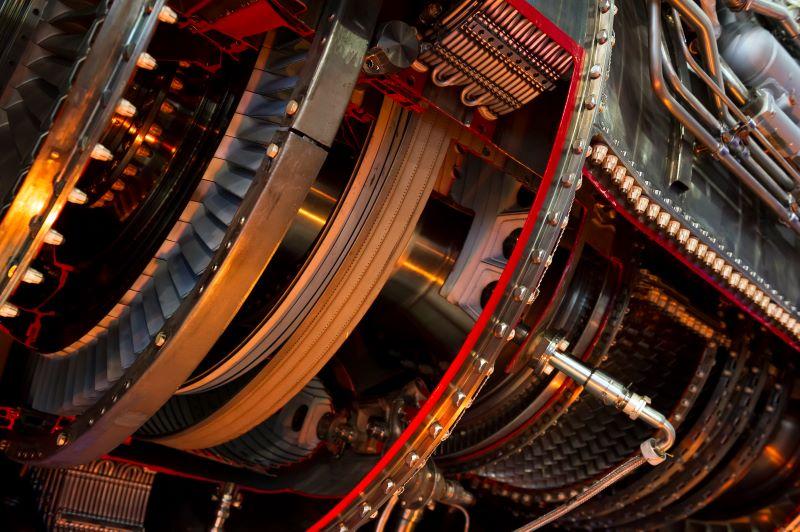

“Heico started out over in the PMA area focused on engine parts, Wencor has focused on non-engine parts,” he said. “Heico also does non-engine parts, but there actually is very little similarity in the product that we do. And as a matter of fact, the Heico component repair stations purchased all of the Wencor PMAs because HEICO doesn’t offer those PMAs.”

Repair work is another area of differentiation. While both offer component repair services, Wencor’s reach and volume is larger.

“Wencor overhauls a lot of components and is in a lot of market niches where Heico is not in, so we think that that’s going to broaden us,” he said.

Wencor’s sales and distribution channels also offer contrasts. While Heico’s primary customers are airlines, Wencor reaches deeper into the supply chain.

“Yes, we serve independent repair stations and brokers and smaller customers,” Mendelson said. “But Wencor really has a world-class e-commerce system, e-commerce platform, which I think is going to be a really great value to our customers.”

The acquisition, made via an auction and expected to close later in 2023, would see Wencor operate as a stand-alone entity within FSG.

“Wencor is a very, very well-run company, and they’ve got tremendous asset in their people,” Mendelson said. “Our plan at the moment is just to acquire it and leave it as a separate stand-alone company for the near term. Let’s see what benefits could exist between the two companies over time.”

The deal comes amid surging demand for aftermarket services, particularly on older platforms that most PMA specialists target. Strong demand for lift combined with new-aircraft delivery figures that have not met manufacturers’ targets in the last several years is keeping older assets in service longer than expected. The trends have helped commercial airline-focused FSG string together eight consecutive quarters of at least 20% organic sales growth.

“It’s one thing to have four quarters where you bounce back, but it’s [at eight],” Mendelson said. “There’s a lot of strength out there.”

Continued recovery in markets and sectors that have not fully bounced back from the global downturn, notably in the Asia-Pacific region, combined with airlines’ efforts to ensure their fleets are available during the coming peak travel seasons, are driving the extended growth.

“I think that the airlines are getting ready for [peaks] season. They know that it’s going to be really tough this summer. Everybody wants to fly, whether it’s for leisure or business. So, as a result, they make sure that they’ve got the inventory.”

While Mendelson acknowledged the growth pace won’t continue indefinitely, the trends have observers looking favorably at Heico’s long-term prospects.

“The post-COVID recovery in air traffic has been highlighted by new aircraft delivery delays that have resulted in airlines having to rely on older aircraft longer than they would like. At the same time, aftermarket parts providers have been raising prices well above inflation,” Melius Research analysts Rob Spingarn wrote in an analyst note. “PMA parts are like generic drugs in that they break aftermarket parts providers monopolistic pricing power. PMAs are typically sold at a 30% discount to OEM parts, and they can alleviate supply chain bottlenecks by providing a secondary source of parts.”

“Typically, when an airline starts using PMAs, they often expand their usage,” Spingarn added. “Long-term, we think demand for PMA parts will be structurally higher. As the world’s leading provider of PMA parts, it is difficult to envision a scenario where Heico is not a post-COVID winner.”